An economy in which kamaʻāina cannot afford to live while non-residents extract value from housing is inherently unstable, and frankly, feels hopeless for younger generations. What we’re seeing now around the Minatoya List is not just an important legal fight, it’s a market signal and a beacon of hope. Lawsuits introduce uncertainty; uncertainty introduces risk. When risk rises, markets respond.

By pushing litigation deeper into the short-term rental (STR) landscape, Minatoya supporters are injecting extrinsic risk into what had been treated as a predictable financial asset (for them). That risk will be priced in. As enforceability, zoning, and future cash flows become less certain, the valuation of homes used primarily as STRs will soften at the margin. Many non-local owners, who have already benefited from years of appreciation and strong yields due to the lack of political will, will decide not to stomach the potential downside. When uncertainty overwhelms confidence, capital can fly out. No one wants to be the last domino either.

Hawaiʻi never had a head start STR strategy to combat Airbnb early or meaningfully. No market did. The tech startup scaled and reshaped housing economics before regulators could respond. Had policymakers known just how lucrative an asset class that STRs would become—Airbnb generating roughly $1.4 million in revenue per employee vs. about $160,000 per employee at Marriott—they might have asked the obvious question sooner: how? The answer lies in structure.

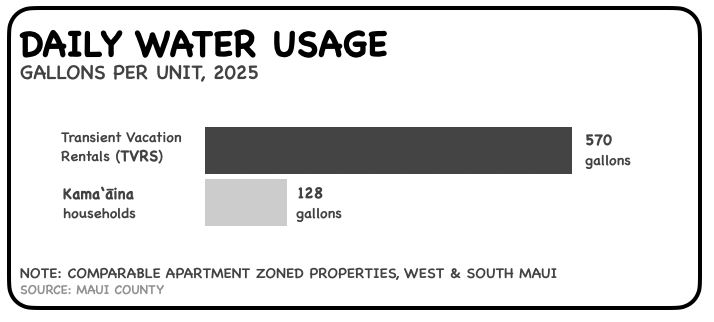

STRs became a financial instrument that captures yield and appreciation while exporting risk to community. Afterall, roughly 94% of STR properties targeted on the Minatoya list are owned by non-Maui residents. Even water usage among STR is 5x kamaʻāina usage. What?

STR privatizes upside while communities absorb infrastructure strain, congestion, and displacement. Housing morphed into an investment vehicle first, shelter second.

Durable, local economies require residents. People who live where they work. People who pay local dentists and barbers, eat at neighborhood restaurants, enroll their kids in sports leagues, and spend money on birthday parties and school fundraisers.

Homes were never intended to function as high-yield income streams. A model like this doesn’t primarily create new value, it arbitrages regulation. Time is up on that.

…

Prediction No. 1: Hawaiʻi’s Systems Get Exposed from the Outside In

Prediction No. 2: More Restaurants Close; Better Ones Open

Prediction No. 3: Entrepreneurship Still Belongs to the Exceptions

Prediction No. 4: Philanthropy Faces More Watchdog Pressure

Prediction No. 5: Kamehameha Schools Has an Old Is New Again Moment

Prediction No. 6: Non-Local Short Term Rental Owners Begin to Blink

Prediction No. 7: DPP Is Hawaiʻi’s Economic Chokepoint